7 ways you could accidentally void your travel insurance

Ready for a fun-filled adventure? Dodge the insurance headaches with our top tips to keep your coverage intact and your journey worry-free.

We’ve all heard the horror stories: the friend of a friend who, on her first night in Italy, had a few too many glasses of red and ended up losing her wallet, only to find out she couldn’t claim it on insurance. Then there’s the work colleague who, while riding a moped in Thailand, broke his leg and had to shoulder the hefty medical bills alone.

Turns out, booze-related accidents void your travel insurance. Also, if it’s not legal to ride a vehicle without a licence at home, it’s not legal for you anywhere – it doesn’t matter if it’s allowed in the country you’re visiting. As savvy travellers, it’s crucial to know these exclusions, so you can holiday with ease. Before your next adventure, dive into the fine print to dodge these potential pitfalls and keep your insurance intact.

1. Leaving your belongings unattended

Most policies will cover your belongings if they are lost, stolen, or accidentally damaged. But all this changes if they’ve been left unattended, in an unsecured location (like hiding in your towel while you swim at the beach), or with someone you don’t know. Even leaving your valuables in a hotel room outside of the safe may be considered unsecured.

Don’t leave your luggage unattended and report missing bags to the authorities.

Moral of the story? Make sure you always keep your most valued belongings with you or ensure they’re safely locked away. If something is stolen, make an official police report outlining the incident within 24 hours. Your insurer may need a reference number or other paperwork from the police to process your claim.

2. Ignoring pre-existing medical conditions

When it comes to travel insurance, honesty is key, and failing to disclose pre-existing medical conditions can lead to a voided insurance claim. You may need to disclose the medications you’re taking, vaccination status, ongoing treatments, and even any pending diagnoses to be safe.

Make sure you’re physically well and mentally prepared.

The same applies if you travel against medical advice or embark on the journey to seek medical treatment. It’s important to be transparent about your health when purchasing a policy to make sure that you’re adequately covered for any unforeseen medical circumstances that may arise.

Be ready for unforeseen medical circumstances while travelling.

For more in-depth information on this topic, check out our article on how to get insurance when you have a medical condition. If you do find yourself needing to make a medical claim, make sure to keep all records and receipts of related expenses.

3. Engaging in reckless behaviours

Holidays often come with a newfound sense of liberation, but don’t leave your common sense at home. Going too hard on the drinking, taking drugs, doing something illegal, or indulging in other risky behaviours might leave you penniless at the end of your adventure – and that’s no fun.

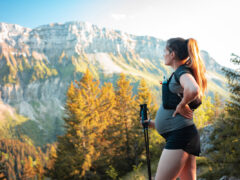

4. Participating in high-risk sports and activities

Adventurous spirits – tread carefully. Not all policies automatically cover pursuits like skydiving, bungee jumping, and skiing – and assuming they do can lead to claim denials. Even scuba diving is not likely to be covered if you’re not certified by an internationally recognised program. If you’re planning a high-adrenaline holiday check if your chosen activities are included in your policy. If not, enquire about additional coverage or policy upgrades to avoid potential financial setbacks in case of unexpected mishaps.

Follow safety reminders to avoid travel accidents. (Image: Vidi Drone)

5. Travelling against government advice

In an era of global connectivity, staying informed about travel advisories is fundamental. Travelling to regions against government warnings can be a fast way to void your insurance for that destination. Check-in with your country’s government website for real-time updates on potential risks and dangers – and exercise caution when considering trips to high-risk destinations.

Stay informed about your holiday destination safety status before flying. (Image: Gary Lopater)

6. Violating road and driving rules

Exploring a new destination often involves navigating unfamiliar roads (or driving on the opposite side of them from what you’re used to!). Renting a car can be a convenient option, but make sure you’re well and truly up to scratch with the rules in the country you’re in.

Whether it’s driving without a valid license or ignoring specific guidelines outlined in both your insurance policy and the rental agreement, such actions can void your coverage. Pay close attention to the rules and limits to ensure your insurance remains active in the event of an incident.

Stick to the road rules while driving overseas and make sure you have a valid driving license.

7. Changing your mind

We get it – travel plans can change, but don’t assume your insurance will cover last-minute alterations. Most policies do not approve claims for changing travel plans, and failing to obtain necessary travel documents (like passports and visas) in time will likely result in denied coverage. Be proactive in your planning and follow the rules set by your insurance provider to prevent any unnecessary setbacks.

Not all policies cover change of mind cancellations. (Image: Pascal Meier)

The main theme here is really all about keeping it real and using good old-fashioned common sense – pretty straightforward, right? Spill the beans on your entire travel plan, keep any necessary documentation, make sure you’ve got your visa and passport, check the fine print, and remember to organise your insurance well in advance. This way, you’ll be on your way to an easy, breezy holiday. Happy travels!

A little govt legislation on what is reasonable on the part of insurers would make a big difference.

For example: the issue of driving rules is effectively a legal double jeopardy and should be covered by insurance. Breach of the road rules is an issue for that country.